Browser Agents, OpenAI & Wildfires

Capital Efficient #5

I’m Pat McGovern and welcome to the fifth edition of Capital Efficient. Let’s get into it.

Weekly Radar

Browser Agents

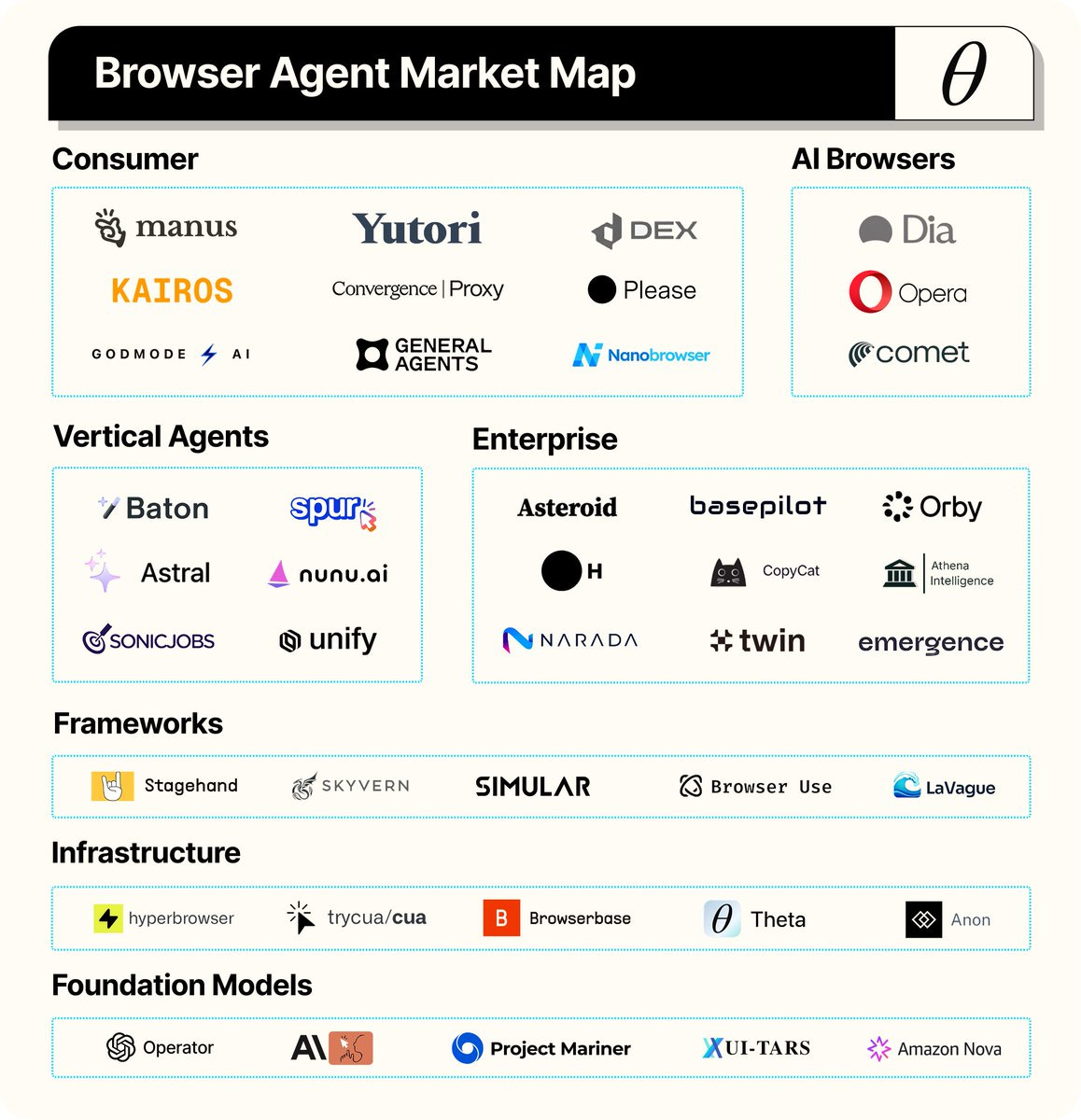

If LLMs are AI’s brain, browser agents are its hands. ChatGPT and Perplexity both recently launched agent-focused browsers, and a new crop of startups is building out the connective tissue between LLMs and the digital world. From SaaS apps to web portals to dashboards - the browser is where modern desk work lives. For those getting up to speed on the space, I’ve included a helpful market map below courtesy of Theta.

For vertical AI startups, browser agents are often the missing execution layer - the bridge between intelligence and action. They enable startups in logistics, healthcare, and insurance to actually do the work they aim to augment or automate. These domain-specific agents, capable of handling complex, industry-tailored workflows, are especially interesting. It’s still an open question whether that layer becomes a standalone market or gets commoditized as general-purpose agent infrastructure improves.

There’s also a future where leading vertical AI platforms build their own browser agents, and where their execution quality determines overall product quality. And there’s another timeline where foundation models develop such powerful agents that the category itself becomes irrelevant.

Re-architecting the internet to be agent-first will be a 5-10 year process. Until then, browser agents that can navigate the web like a human will be essential if AI is going to fulfill its potential in the workplace.

VC Expectations → ARR Inflation

It’s time for a reset on early-stage revenue expectations.

Here’s the current state of play:

VC’s publish select, unrepresentative examples of super high-growth companies, largely ones that are prosumer or selling to other startups. And then message that any startup not growing $0→$5MM in Year 1 isn’t interesting.

Founders overcorrect in response. They inflate ARR in their decks, claim one-time pilots are recurring, fudge selling months, and position estimated expansions and unsigned revenue as ARR.

VC’s get mad that founders are lying to them (and, in the process, committing borderline securities fraud).

My view: building a durable, high-growth business isn’t always going to allow for a $0 → $5MM Year 1 ramp. VC’s - let’s all take a breath. And founders - just tell the truth - there is nothing worse for trust than having to walk back and reclassify revenue the bulk of your ‘revenue’ on call #2 once the questions start flying.

Disclaimer: this is not aimed at any particular founder; this is an observation of an incentive structure in today’s early stage market which isn’t particularly healthy for trust building.

Deals

OpenAI Goes Public Benefit: At long last, OpenAI announced its plan to make the switch from non-profit to a quasi-for-profit model. As part of this transition, Microsoft will get a 27% stake in the successor entity, and OpenAI will be reconstituted as a public benefit corporation overseen by the OpenAI Foundation. MSFT also gets a 20% revenue share in OpenAI, but only until an expert panel determines AGI has been achieved. With OAI revenues continuing to ramp into the tens of billions, this is setting both parties up for a fun “are we there yet?” game on the question of AGI.

Seeing AGI popping up this week in MSFT corporate press releases is another sign we have crossed the rubicon re: AGI going mainstream. Founders should position their products around the assumption that baseline AI improves dramatically in the next few years. Build where the puck is going.

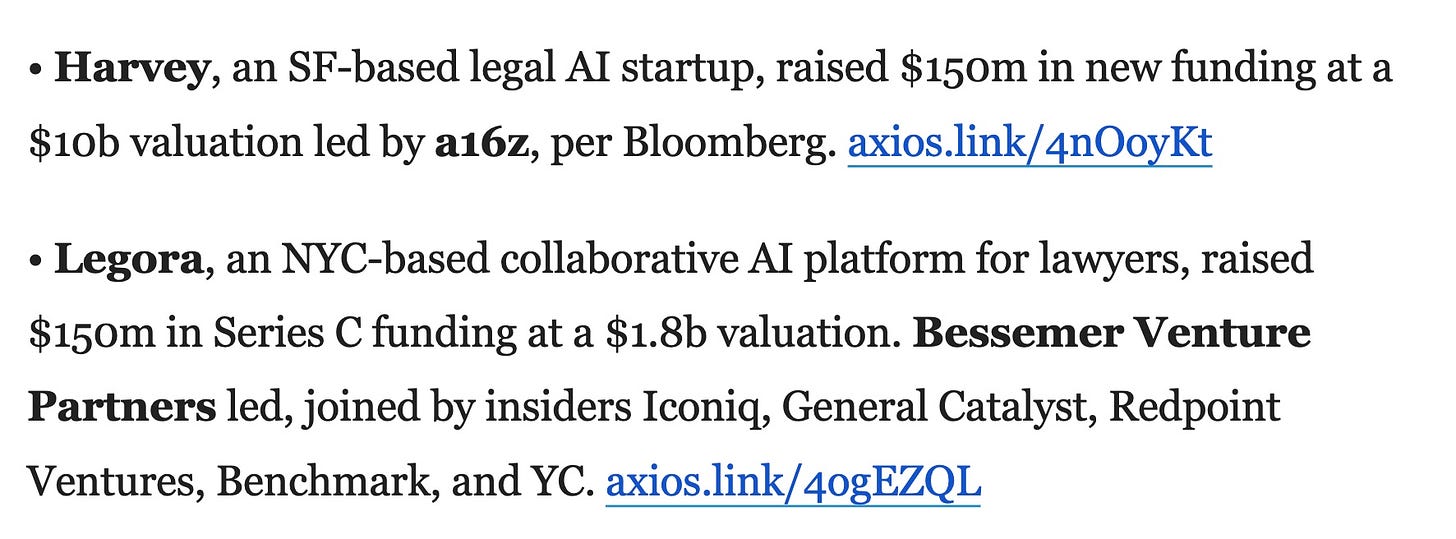

Legal AI Faceoff: This week was a big one for legal AI announcements, with Harvey and Legora both announcing $150MM rounds (although Harvey’s was done at 5x the valuation). Many of the fastest-growing vertical AI platforms sell high-ACV, enterprise products to professional services firms who are facing pressure to adopt AI to remain competitive. The rare back-to-back announcement screenshot below is courtesy of yesterday’s Axios Pro-Rata:

Legal AI is already seeing winners emerge and companies like Hebbia and Rogo are playing similar roles in finance/consulting. AI in these categories is seeing adoption by blue chip customers who would have never trusted AI even two years ago.

Accounting still doesn’t have a clear early winner as the AI platform of record. And most of the innovation capital there has been going towards AI-flavored rollups. As foundation models get better at wrangling spreadsheets, expect an analogous funding arms race in that space.

What I Am Reading

The AI Wildfire: Dion Lim’s fantastic piece in

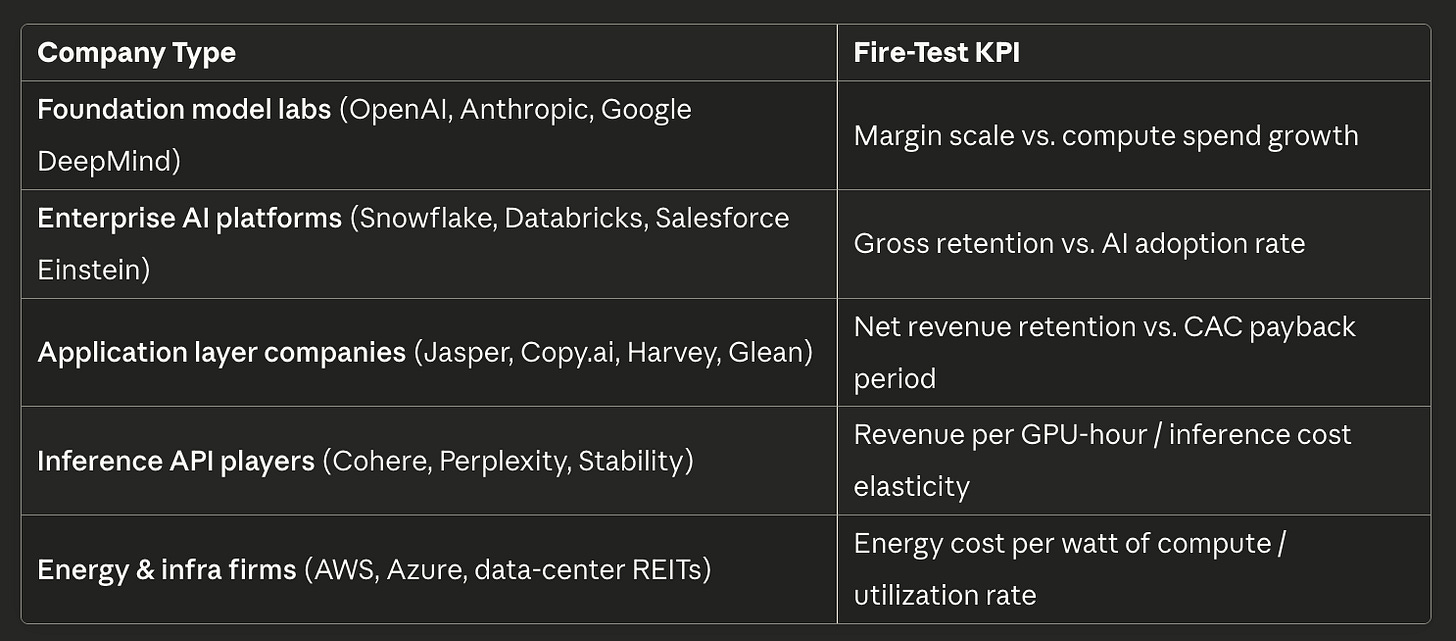

uses the metaphor of AI as a wildfire (vs. a bubble) to take stock of the tech landscape. Fun fact from this one: AMZN traded at ~$5/share in 2000 before drawing down 95% to ~$0.30/share, only to then return an aggregate ~720x over the next 20 years (the biggest swing by an order of magnitude of any of the Web 1.0 and 2.0 public co’s he analyzes). Dion’s breakdown of Fire-Test KPIs by different players in the AI value chain is a sharp lens for thinking about durability. Worth reading the whole thing.

Blowing Bubbles: Max Schoening from Notion lays out where he sees AI as having achieved true PMF. I think we are starting to see it in certain verticals at the app layer as well (e.g., prior authorization management, legal doc drafting) but, Max makes a strong case for the early breakouts.

Perfect timing. Agents as AI's hands is briliant, that re-architecture will be quite something.