AI-Native Big Law, Claude Code Weekend & Fast Takeoffs

Capital Efficient #9

Weekly Radar

AI-Native Big Law

Last month I wrote about Crosby, a new AI-native law firm targeting startups. Now there’s a new entrant going after the other end of the market, Norm AI.

Norm AI started in 2022 as a regulatory agent company selling compliance software to major financial institutions. But last month they announced something exciting. Norm AI is launching Norm Law LLP, a full-fledged law firm that intends to compete directly with Big Law.

Source: https://www.normlaw.com.

Norm Law LLP would be the first AI Services startup I have seen that aims to compete directly with blue chip providers for their top clients, instead of simply serving the long tail (i.e., startups and SMBs). In conjunction with the launch of Norm Law LLP, Norm announced they had raised another $50MM from Blackstone - the business has raised a total of $140MM to date. Other investors include Bain Capital, Citi, TIAA, Coatue, Henry Kravis, and Marc Benioff.

Norm Law is branding its approach as “legal engineering.” The startup has hired a few dozen attorneys with Big Law pedigrees and has them working hand in glove with in-house AI engineers to convert legal workflows into agents that they can offload their lawyering onto. Lawyers design the logic while engineers build the agents, with lawyers then overseeing their deployment.

Norm has also brought on some heavy hitters to beef up their legal bona fides including Ben Lawsky (former NY DFS Superintendent, familiar to any crypto investor), Troy Paredes (former SEC Commissioner), and Dan Berkovitz (former SEC General Counsel). Now, they’re hiring partners, associates, and paralegals. So how does this shake out?

Crosby wins the startup market. Startups are AI-native themselves, prioritize speed and price over pedigree, and lack existing vendor relationships. Crosby could also keep growing with these startups and eventually become equivalent to a tech-focused law firm a la Cooley or Gunderson.

Norm Law (and its competitors) knock out Tier Two Big Law. The bottom half of the AmLaw 250 lacks the brand to survive on reputation and is too slow to modernize from within. AI-native firms like Norm Law can win here and establish themselves as true alternatives to expensive second and third-tier Big Law firms which charge rates commensurate with the AmLaw 20.

Tier One Big Law survives. Firms like Skadden, Paul Weiss, et al. will end up adopting Harvey/Legora or building engineering talent in-house (most likely the former). They have the relationships, brand, and reputation that will probably help them ride out the transition and will adapt just like they have through past shifts.

Expect other AI startups in accounting, comms, and professional services to make a similar pivot. Competing directly as the service provider may be a better value prop than being another IT vendor, if you can actually drive up margins with AI. And if you can’t, your AI platform probably didn’t work that well anyway and won’t command a good ACV.

AI Agents Cross the Chasm

Kenn So’s (Kenn So) annual AI Trends report dropped last week. Kenn is a very bright thinker on all things AI and the whole thing is worth reading, but two findings stood out to me.

AI is matching human professionals in quality. On the GDPVal benchmark, which tests whether AI can produce professional-grade deliverables like 3D engineering models and financial analyses, GPT-5.2 matches or beats human experts (avg. 14 years experience) more often than not (~70%).

There is certainly some benchmaxxing in these numbers but assume this trend holds.

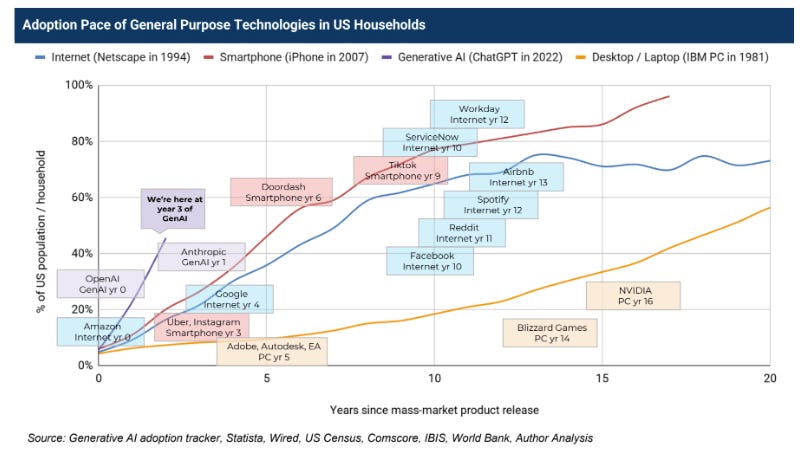

The capability of these models is informing adoption. AI adoption is insanely fast vs. other disruptive tech (see chart below) and better performance begets more usage. A year ago I used AI a lot less - the same interfaces (Claude/ChatGPT) are materially more useful now. Not to mention new entrants like Google/Grok. Adoption of AI is far ahead of PCs, smartphones, or the Internet when they were at this point in their lifecycle and is only poised to accelerate.

Source: Kenn So @ Generational

Claude Code Weekend

Claude Code had a big few weeks over the holidays. Every VC and vacationing startup employee was cranking away on side projects. I was one of them.

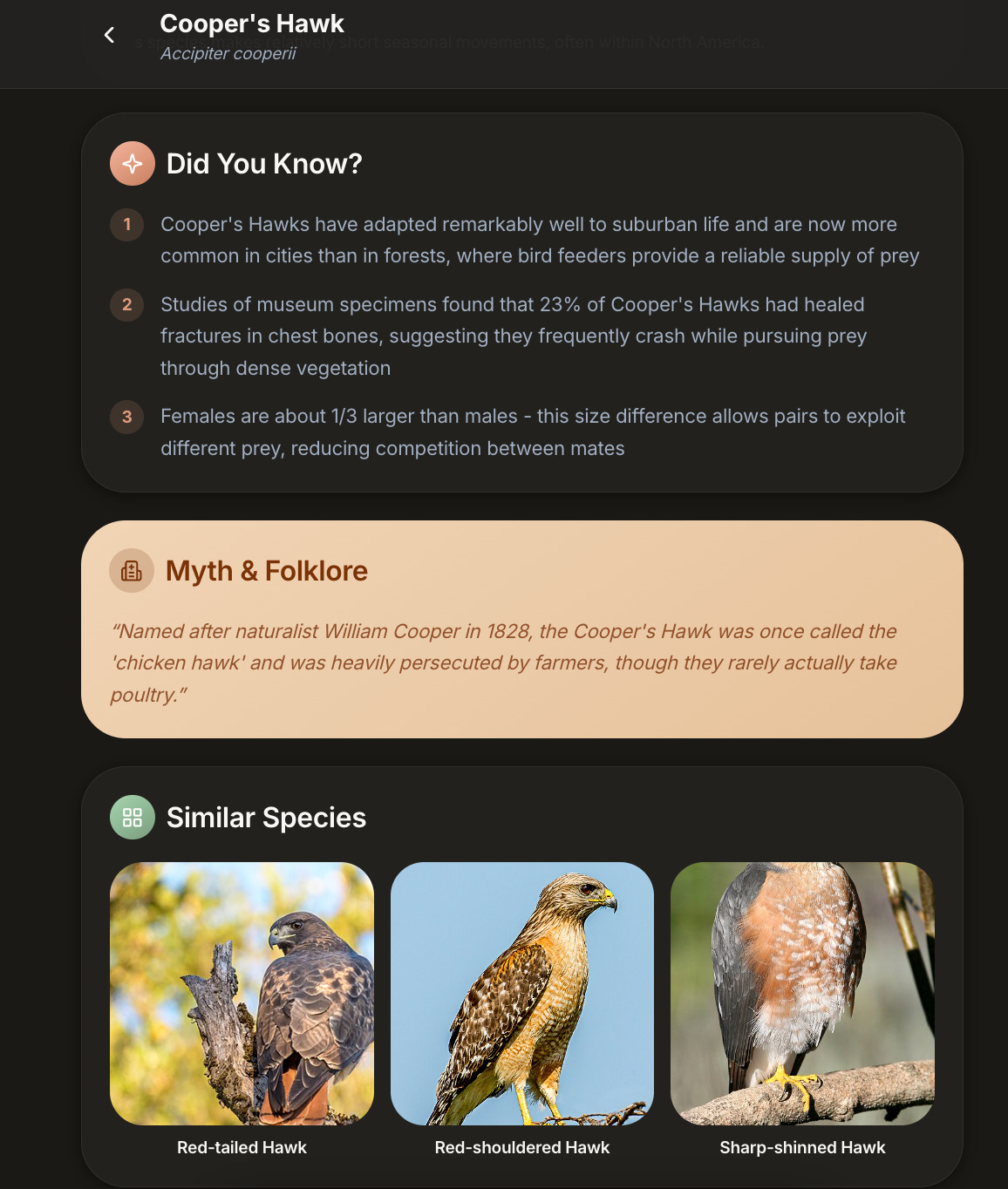

In two days I built and deployed a birding app (basically a crude, localized version of Merlin). I built agents to automate a bunch of personal workflows. I built a vertical AI ARR/employee site (watch out for its debut). And all of this with…well, let’s just call it, limited technical ability.

It’s cliché and hype-y, but it’s also real. And it’s extremely fun. The gap between what you can think up and what you can ship is shrinking. Everyone should be playing with this stuff. It’s entertaining, it’s educational, and it shows you how far things have come (and offers a preview of where we are heading).

My view: we’ve crossed the Rubicon in the last few months and I’m coming around to the fast takeoff (TM) theory.

And for vanity’s sake - a screenshot of my janky Merlin competitor is below. As you can see, Claude isn’t great at centering birds in preview images just yet.

Deals

Slow week for announcements given the holidays, but two mega-acquisitions dropped since our last edition.

Manus → Meta (~$3B, ~$125MM run rate)

Meta bought Manus for a rumored $3B at the end of December. I tried Manus when it launched and didn’t fully get it, but Wide Research and other agent-driven search features won over converts. One rumor is that Meta may use the tech to help businesses run ad campaigns and offer them a SMB toolkit. Another is that this is just a talent buy given their AI struggles to date (see LeCun v. Wang). I don’t think this ends up an Instagram-tier GOAT acquisition, but let’s check back in a year.

Groq → Nvidia ($20B)

Nvidia also had a buzzer beater license & hire acquisition, paying $20B for Groq’s assets and key talent in the waning days of December. The deal was structured as a “non-exclusive licensing agreement” - presumably to dodge antitrust review. Groq was valued at $6.9B three months ago and Nvidia paid 3x that. This helps Nvidia head off a potential competitor and further solidify its place in the AI hardware ecosystem.

What I’m Reading

Capital in the 22nd Century: Some really big-brain thinking on the logical endpoints of the more extreme “AI will eat the world” views. Worth a read with an open mind.

Dan Wang’s 2025 Letter: Every other VC has already recommended this on X, but I’d be remiss not to include it here. Great annual letter from a close observer of tech and China.

The Billionaire Baby Boom: Head-spinning WSJ piece on billionaires using unscrupulous surrogacy agencies to have dozens of children. And I thought it was just Elon.

The Epstein Investigation: Good nitty-gritty reporting by the NYT investigative team on Epstein’s early years and his lifelong history of fraud.

Interesting! AI-Native Law Firms are not only targeting underrepresented verticals such as SMBs and Startups. They're expanding into areas of BigLaw as well. I think the opportunity for these firms is to build in areas of demand such as Arbitration, Technology-risk advisory and ESG which are relatively new that BigLaw has not yet established it's practice in. Furthermore, after they've established themselves in 1-2 areas then they can venture into practice areas such as M&A, Corporate Finance and Competition Law where BigLaw has traditionally dominated.

I write a newsletter on LegalTech analyzing trends and opportunities for building. Would love to get your thoughts on my latest post analyzing three whitpaces for investment opportunities in the space.

https://open.substack.com/pub/harshithviswanath/p/three-legaltech-whitespace-plays?utm_source=share&utm_medium=android&r=4y4gfu